As tax season approaches, businesses and trusts alike face the challenge of navigating complex financial regulations while ensuring compliance with the latest tax laws. For many of us, the task of filing our business taxes can be daunting, but thankfully there are tools designed to simplify the process.One such tool is the TurboTax Business 2024 Tax Software.In this review, we will share our first-hand experience with this latest iteration of TurboTax, focusing on its features, usability, and support for various business structures, including partnerships, S-Corps, and llcs.

TurboTax Business 2024 promises to empower users with the confidence to file accurately and efficiently, offering a range of functionalities such as automatic coaching throughout the filing process and industry-specific tax deductions. additionally, its ability to handle multiple tax forms, such as W-2s and 1099s, further streamlines the experience. With recent updates and enhancements, we are eager to evaluate how well this software meets our needs and the needs of business owners across the board. Join us as we dive into the features,benefits,and potential drawbacks of TurboTax Business 2024 Tax software.

Table of Contents

overview of turbotax Business 2024 Tax Software

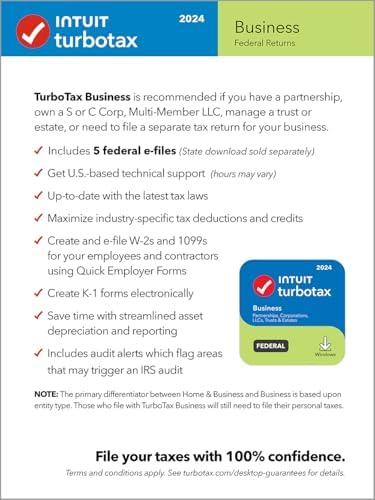

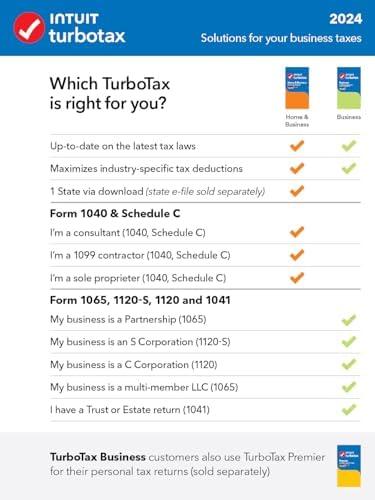

The latest tax software from Intuit simplifies the process of preparing and filing business taxes, ensuring we can tackle our responsibilities with confidence. This program is especially beneficial for those who have partnerships, S or C corporations, Multi-Member LLCs, or manage trusts and estates. We appreciate how it not only assists us in filing our business taxes but also guides us through each step, ensuring that our returns are as accurate as possible. Its ability to seamlessly create W-2s and 1099s for employees and contractors using Fast Employer Forms adds significant value to our overall tax management process.

One of the standout features is the inclusion of 5 Federal e-files, which allows us to manage our filings efficiently, while additional state forms are conveniently available for download. Staying compliant with the latest tax laws is crucial, and we find comfort in the software’s up-to-date information. Notably, audit alerts help identify potential red flags, which can save us from unexpected scrutiny from the IRS. The program’s capability to streamline asset depreciation and reporting is another advantage, making tax filing a streamlined experience.

| Feature | Benefits |

|---|---|

| Entity Type Recommendations | Ideal for partnerships, S/C Corps, LLCs, trusts |

| Federal E-filing | Includes 5 Federal e-files |

| W-2s & 1099s Creation | Quick Employer Forms for employee/contractor payments |

| Audit Alerts | Identifies high-risk areas to prevent IRS audits |

Explore TurboTax Business 2024 Now

Key Features and Functionalities of TurboTax Business 2024

Key Features and functionalities

The software offers comprehensive support for various business structures, making it suitable for partnerships, S or C Corporations, Multi-Member LLCs, and trusts. It provides guidance throughout the tax filing process and ensures that the return is checked for accuracy before submission. Users can file up to 5 Federal e-files,though it’s critically important to note that state business forms must be purchased separately. The application is designed to keep users updated with the latest tax laws, allowing us to maximize our tax deductions and credits tailored to our specific industry.

Additionally, the tool provides functionalities that streamline tax reporting, enabling us to create and e-file essential forms such as W-2s and 1099s directly through Quick Employer Forms. It also supports K-1 forms creation in PDF format and includes features that simplify asset depreciation calculations. With built-in audit alerts, the software highlights areas that may trigger IRS audits, ensuring we can proactively address potential issues. For those requiring assistance, U.S.-based technical support is available to guide us as needed.

Get Your TurboTax Business 2024 Today!

In-Depth Insights into User Experience and Performance

The experience of using this tax software is characterized by its user-centric design, which fosters a confident approach to filing business and trust taxes. we appreciate the built-in coaching feature that guides us through each step, ensuring that crucial details are not overlooked. This proactive double-checking mechanism minimizes the risk of common errors, allowing us to navigate complexities associated with partnerships, S or C Corporations, and Multi-Member LLCs with relative ease.Additionally, the inclusion of 5 Federal e-files considerably streamlines the process, although it’s important to remember that state forms must be downloaded separately.

Performance-wise, the software stands out by providing timely updates on changing tax laws, enabling our businesses to take advantage of relevant deductions strictly tailored to our industry.Creating W-2s and 1099s for employees and contractors is simplified through Quick Employer Forms. Furthermore, the option to electronically generate K-1 forms in PDF format is both time-saving and efficient.We also appreciate the audit alerts feature, which proactively highlights areas of our return that may attract IRS attention, thus offering an extra layer of security. Given that this solution is only available for Windows, users should ensure compatibility prior to purchase.

Explore More and Purchase Here

Recommendations for Maximizing the Benefits of TurboTax Business 2024

To fully leverage the capabilities of this tax software, we recommend starting with a thorough understanding of your business structure, whether you are operating as a partnership, S or C corporation, or Multi-Member LLC. Utilize the built-in guidance to navigate your specific tax requirements and ensure accurate filing. As it permits five federal e-files, we suggest planning your submissions strategically based on your preparations, as this feature can definitely help manage any necessary adjustments or corrections seamlessly.Additionally, we should take advantage of the industry-specific tax deductions and credits offered.By staying informed about the latest tax laws integrated into the software, we can maximize our deductions efficiently. To further streamline the process,consider using Quick Employer Forms for quick creation of W-2s and 1099s,which helps in adhering to compliance and avoids common reporting errors. lastly, make sure to monitor audit alerts provided by the software, as they can significantly reduce the risk of an IRS audit by flagging potential issues early in the filing process.

Get TurboTax business 2024 Now!

Customer Reviews Analysis

Customer reviews Analysis

As we delve into the feedback provided by users of the TurboTax Business 2024 Tax Software, several key themes emerge regarding the product’s functionality, user experience, and support services. Our analysis highlights both positive and negative reviews to give a balanced overview of customer sentiments.

positive Feedback

- User-Friendliness: Many users appreciate the intuitive design and straightforward instructions of TurboTax Business 2024. one user stated,”Their instructions are easy to follow,and you have guidance along every step if needed.”

- Tools for Businesses: Customers noted that the software is particularly well-suited for various business structures, mentioning its utility in generating forms such as W-2s and 1099s.

- Quick Download and Installation: Multiple reviewers praised the ease of downloading the software, citing a hassle-free experience when obtaining the product online.

- Regular Updates: Users highlighted that TurboTax stays current with tax laws, a crucial feature for business compliance.

Negative Feedback

- Installation Issues: A significant number of users reported installation problems, particularly related to C++ Redistributables, leading to frustration and time lost. One review noted that the Intuit support recommendations were not helpful.

- Customer Support concerns: Reviews reflected a high level of dissatisfaction with intuit’s customer support. Users encountered difficulties navigating the automated system, experienced long wait times, and received inconsistent information when addressing their issues.

- Cost Considerations: Some customers expressed concerns regarding the pricing model, particularly the additional costs for state tax filing,which they felt were excessively high.

- Mandatory Online Login: The requirement to log in to Intuit to use the software was another point of contention,with users citing complications related to password retrieval and account creation.

Summary of Pros and Cons

| Pros | Cons |

|---|---|

| Easy to use with clear instructions | Installation issues due to software incompatibilities |

| Effective tools for various business types | Poor customer support experience |

| Updated with latest tax laws | High price, especially for state forms |

| Quick and straightforward download | Mandatory login complicating access |

while the TurboTax Business 2024 Tax Software has garnered positive reviews due to its ease of use and comprehensive tools for businesses, significant concerns regarding installation processes and customer support cannot be overlooked. As we evaluate this tax software, potential users should weigh these factors based on their specific needs and expectations.

Pros & Cons

Pros & Cons of TurboTax Business 2024

In our assessment of TurboTax Business 2024, we’ve identified several advantages and drawbacks that users should consider before making a decision. Below is a summary of the pros and cons associated with this tax software:

| Pros | Cons |

|---|---|

| Intuitive coaching throughout the filing process ensures confidence in accuracy. | Available only for Windows users, limiting access for Mac users. |

| Utilizes up-to-date tax laws, making tax filing simpler and compliant. | Business State forms are sold separately, which may add to overall cost. |

| Includes audit alerts that help flag potential issues that could trigger an IRS audit. | U.S.-based technical support hours may vary, potentially affecting availability. |

| Streamlined asset depreciation and reporting saves time during the filing process. | Requires users to file their personal taxes separately. |

| Ability to create W-2s and 1099s electronically enhances convenience for businesses. | Not suitable for those needing a tax solution for individual tax returns. |

turbotax Business 2024 presents a solid option for business and trust tax filing, especially for those who need specialized features and support. Though, potential users should weigh the limitations against the benefits to determine if it meets their specific needs.

Embody Excellence

TurboTax Business 2024 proves to be a reliable choice for business owners and those managing trusts. With its comprehensive features, real-time guidance, and up-to-date tax law information, we believe it effectively meets the needs of individuals filing complicated business tax returns. The inclusion of industry-specific deductions and the ability to create essential forms like W-2s and 1099s adds significant value, particularly for multi-member LLCs, S Corps, and partnerships.

While it is indeed crucial to remember that TurboTax Business focuses solely on business tax returns, we appreciate how it streamlines the overall process, allowing us to file with greater confidence. However,we also recommend assessing your specific requirements,especially regarding state forms and personal tax returns,which still need to be filed separately.For those ready to take control of their taxes this season with TurboTax Business 2024, you can find more information and make a purchase through this link: TurboTax Business 2024 Tax Software – Get Started Today!. Thank you for reading our complete review, and we hope it has been helpful in your decision-making process!