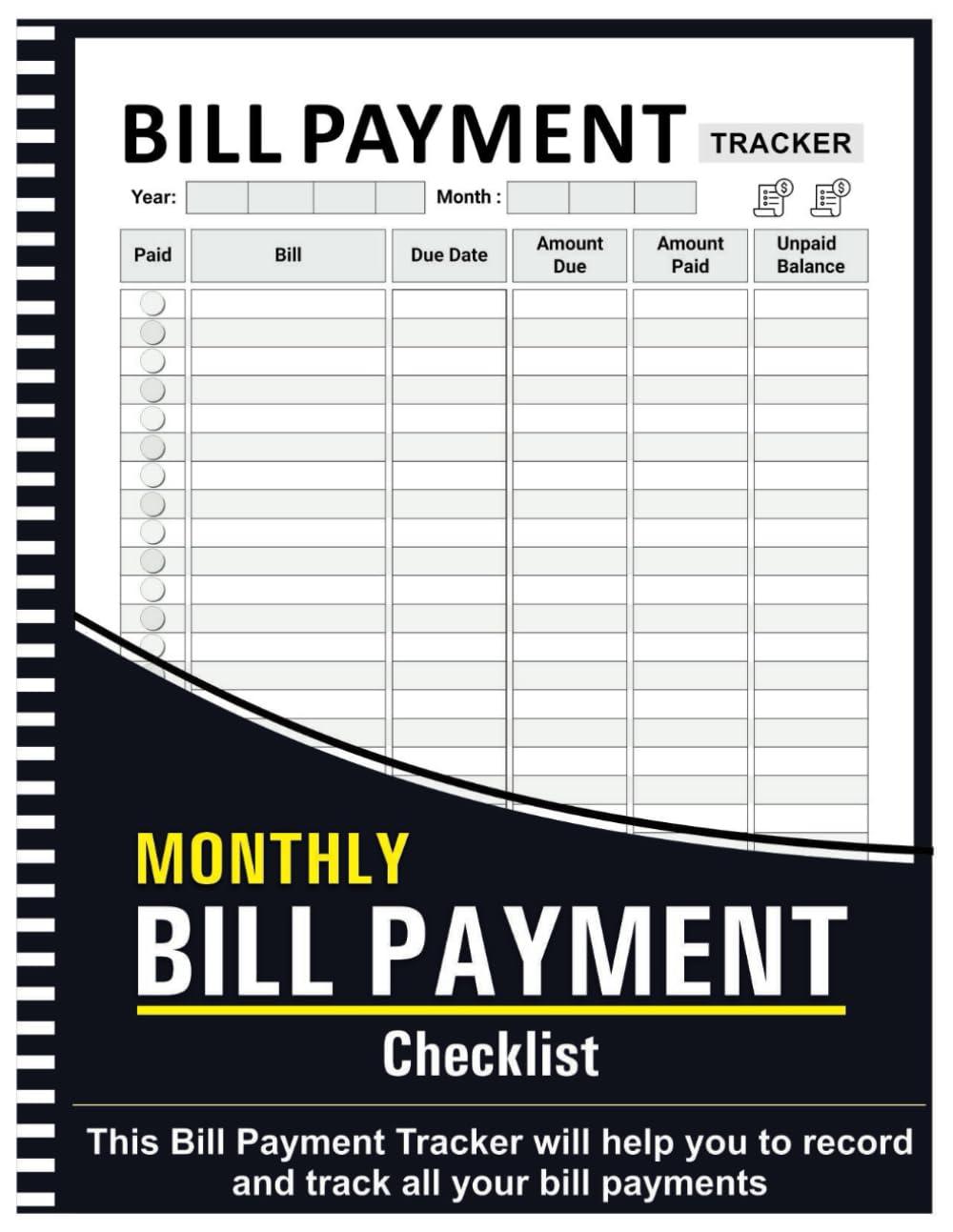

In today’s fast-paced financial landscape, staying organized with our bills has never been more crucial.That’s where the Bill Tracker Notebook: Monthly Bill Payment Checklist comes into play. With dimensions of 8.5″ x 11″ and over 100 pages, this paperback notebook promises to be a comprehensive solution for managing our monthly expenses. We’ve had the prospect to use this product since its release by Zak Market Inc in June 2023, and we’re excited to share our insights.

The design of the Bill Tracker Notebook is straightforward yet effective, catering to anyone who wants to take charge of their financial obligations without the distractions of digital devices. With a clean layout that allows for easy entries, we found it to be a user-friendly tool that fits seamlessly into our budgeting routines. In this review, we’ll delve deeper into its features, usability, and overall effectiveness, allowing us to determine whether this notebook truly lives up to its promise as a monthly bill payment checklist. join us as we explore how this simple yet powerful tool can impact our financial management strategies.

Table of Contents

Overview of the Bill Tracker Notebook and Its Purpose

We appreciate the design and utility of this notebook,which caters specifically to individuals looking to streamline their monthly billing process. With over 100 pages, it provides ample space for documenting bills, due dates, and payment statuses. The dimensions of 8.5″ x 11″ ensure that it’s large enough to wriet comfortably, while remaining portable for on-the-go use. As we navigate our financial responsibilities, having a dedicated space to track our expenditures becomes vital for effective budgeting and timely payments.

Our experience with this product reveals its thoughtful layout, which includes a monthly bill payment checklist that offers a clear overview of what needs to be paid each month. This organized approach helps us to avoid late fees and manage our finances more effectively. The sturdy paper used in its construction prevents bleed-through from ink, ensuring the longevity of our notes. As we aim to enhance our financial awareness, this notebook stands out as an essential tool in our budgeting arsenal. To make your financial tracking easier, consider checking it out hear.

Key Features and Design Elements that enhance Usability

the notebook is thoughtfully designed to streamline our monthly bill management process. With a size of 8.5″ x 11″, it provides ample space for us to document various billing details without feeling cramped. The 110 pages are printed on high-quality paper, designed to withstand frequent use while preventing ink bleed-through. Utilizing a checklist format not only enhances organization but also allows us to easily track our payments and deadlines at a glance. Its compact thickness of 0.25 inches makes it convenient to store on a bookshelf or in a drawer, ensuring it’s always within reach when needed.

One standout feature is the incorporation of dedicated sections for different types of bills, which promotes clarity and ease of access. The minimalist design keeps distractions to a minimum, enabling us to focus solely on managing our finances. Additionally, the clean layout and logical flow of information facilitate a user-friendly experience.To visualize this, we can summarize key features in the table below:

| Feature | Description |

|---|---|

| Size | 8.5″ x 11″ |

| Pages | 110 Pages |

| Checklist Format | Easy tracking of payments |

| Material | High-quality, bleed-resistant paper |

For those interested in elevating their bill management experience, we encourage you to explore the product further by clicking the link below.

Detailed insights from Our Experience with the Product

Our experience with this notebook has been notably positive. With 110 pages at a convenient size of 8.5″ x 11″, it offers ample space for organizing our monthly bill payments efficiently. The layout is designed for clarity, allowing us to quickly jot down due dates, amounts, and payment status without feeling cramped. The quality of the pages provides a smooth writing experience, and we appreciate the sturdy binding that can withstand regular use, maintaining its integrity over time.

One aspect we found particularly helpful was the monthly bill payment checklist that guides us through our payments systematically. This feature has made it easier to track our finances and avoid missed payments. Below is a quick summary of some key specifications that enhance the usability of the notebook:

| Feature | Details |

|---|---|

| Publisher | Zak Market inc |

| Publication Date | June 7, 2023 |

| Language | English |

| Weight | 9.6 ounces |

| ISBN-13 | 979-8987211977 |

this product has become an integral part of our budgeting routine, providing us with structure and peace of mind. For anyone looking to streamline their bill management process, we highly recommend checking it out. See it on Amazon

Recommendations for Maximizing the Benefits of the Bill Tracker Notebook

To make the most out of our bill tracker, we recommend setting aside a specific time each month to update and review our payment checklist. Developing a routine not only ensures that we stay organized, but also helps us avoid late fees and missed payments. It can be beneficial to have a dedicated place for our notebook where it is indeed easily accessible, enabling us to jot down notes or adjustments as needed. Creating monthly goals related to our bill payments can enhance our financial awareness and motivation, allowing us to assess our monthly expenditures and make informed budgeting decisions.

In addition, we suggest incorporating color coding or symbols within the pages to visually differentiate between types of bills. This technique can simplify tracking and make the process more engaging. Utilizing the 100+ pages effectively, we can create a monthly summary table to highlight major bills or expenses, keeping everything streamlined and organized. The following table illustrates how we can categorize our financial obligations:

| Type of Bill | Due Date | Amount | Status |

|---|---|---|---|

| Utilities | 1st | $100 | Paid |

| Mortgage | 5th | $1,500 | Pending |

| Internet | 10th | $60 | Paid |

By implementing these strategies, we can enhance our financial management and maintain control over our budgeting process. For ease and convenience, we recommend checking out our recommended resource here for acquiring the notebook.

Customer Reviews Analysis

Customer Reviews Analysis

In our exploration of the Bill Tracker Notebook, we have compiled a range of customer reviews that reflect users’ experiences and insights regarding the product. the feedback is mixed, with various individuals highlighting both strengths and limitations of the notebook.

Positive aspects

Several customers praised the notebook for its functionality and design. The following points were commonly mentioned:

- Size and Layout: Many users appreciated the large 8.5” x 11” size, which allows for easy visibility and organization of bills. The layout of each monthly checklist was noted as being practical for tracking due dates and balances.

- Paper Quality: Feedback revealed that the notebook’s thick pages prevent bleed-through, making it suitable for various writing instruments.

- Overall Utility: Customers expressed satisfaction in using the notebook as a simple yet effective tool for managing monthly bills.One review highlighted its role in simplifying financial management,especially during life transitions such as divorce.

Critiques and Suggestions

Despite the praise,our analysis also uncovered some critiques regarding the Bill tracker Notebook:

- Binding Preference: A few customers expressed disappointment that the notebook is not a spiral format,as indicated in the original product photo. They believed a spiral binding would enhance usability.

- Specific Needs: Some customers found that the notebook didn’t meet all their personal needs, leading them to either re-gift the product or indicate they might not purchase it again.

Summary of Customer Ratings

To provide a clearer picture of customer sentiments, we created a summary table reflecting the key aspects highlighted in the reviews.

| Aspect | Positive Feedback | Negative Feedback |

|---|---|---|

| Size | Large and easy to read | None noted |

| Paper Quality | Thick, no bleed-through | None noted |

| Binding | Simple design | Preference for spiral binding |

| Usability | Effective for budgeting | Didn’t meet everyone’s needs |

the Bill Tracker Notebook has proven to be a valuable resource for many users looking to streamline their bill payment processes. However, some preferences regarding its design and individual needs may affect potential buyers. As we reflect on this analysis, it’s clear that while the notebook is equipped with essential features, it may not suit everyone’s requirements.

pros & Cons

Pros & Cons

in evaluating the Bill Tracker Notebook: Monthly Bill Payment Checklist, we’ve gathered a comprehensive list of advantages and disadvantages that might help us determine if it fits our needs for managing expenses efficiently.

Pros

- Structured Layout: The notebook offers a well-organized layout with dedicated sections to list and track bills, making it easy for us to manage payments.

- Ample Pages: With over 100 pages, we have plenty of space to document bills month after month, allowing us to maintain a complete record over time.

- Portable Size: The dimensions of 8.5″ x 11″ make it large enough to write comfortably while still being portable enough to carry in a bag.

- Encourages Accountability: By regularly logging our bills, we can keep better track of due dates and amounts, helping us avoid late fees.

- High-Quality Paper: The paper quality ensures that our writing remains smudge-free, whether we use pen or pencil.

Cons

- Lack of Digital Integration: The notebook dose not offer a digital component, which some of us might find useful for on-the-go access.

- Limited Customization: The structured design may not cater to those who prefer a more flexible approach to organizing their bills.

- Bulkiness: While portable, the notebook can feel bulky for those who prefer lighter, more compact solutions.

- No Built-in Budgeting tools: The notebook focuses primarily on bill tracking and does not include additional budgeting or expense tracking features.

- single Language: Currently, it is only available in English, which could be a limitation for non-English speakers.

Summary Table

| Pros | Cons |

|---|---|

| Structured Layout | Lack of Digital Integration |

| Ample Pages | Limited Customization |

| Portable Size | Bulky Design |

| Encourages Accountability | No Built-in Budgeting Tools |

| High-Quality Paper | Single Language Availability |

By considering these pros and cons, we can better understand if the Bill Tracker Notebook aligns with our bill tracking needs and preferences.

Elevate Your Lifestyle

our exploration of the Bill Tracker Notebook has revealed a practical tool designed to simplify the often-overwhelming task of managing monthly bill payments. With its spacious pages and organized layout,it provides an effective way for us to stay on top of our financial commitments. The notebook’s thoughtful design features can enhance our budgeting process and bring clarity to our monthly expenses.

Ultimately,whether we’re experienced budgeters or looking for a way to get our financial house in order,this Bill Tracker Notebook could be a helpful addition to our organizational arsenal. If you’re ready to take control of your bills and foster better financial habits, we encourage you to consider giving this product a try.

To purchase the Bill Tracker Notebook, click here: Bill Tracker notebook on Amazon.