As tax season approaches, many of us find ourselves searching for teh best tools to streamline the process and ensure accuracy in our filings. This year,we turned our attention to TurboTax Home & Business 2024 Tax Software—a product designed specifically for individuals with unique tax situations,such as self-employed professionals,freelancers,and small business owners. With its promise of helping users file confidently by uncovering more than 375 personal and small business deductions and credits, we were eager to explore what this software has to offer.

In this review, we’ll delve into our firsthand experience with TurboTax 2024, examining its features, usability, and overall efficiency in assisting us with both federal and state tax returns. We’ll also consider the potential benefits for those of us navigating the complexities of self-employment and small business taxes, while highlighting the new features that set this software apart from its predecessors. Join us as we unpack what TurboTax Home & Business 2024 can do for you this tax season.

Table of Contents

Overview of TurboTax Home & Business 2024 Tax Software

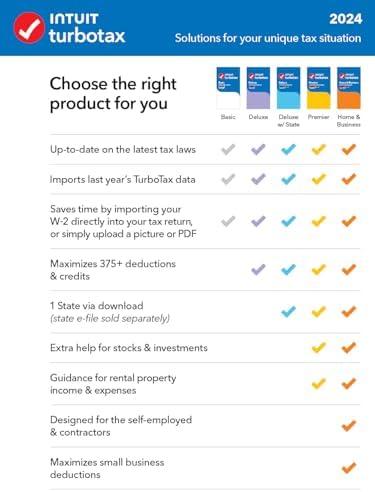

The latest version of this tax software is designed with self-employed individuals and small business owners in mind. It offers a comprehensive range of features that help us maximize our deductions and credits, searching through over 375 potential savings opportunities tailored to our unique situations. Whether we are freelancers, independent contractors, or sole proprietors, the software provides valuable insights into industry-specific deductions that can significantly boost our bottom line. Additionally, it simplifies the tax process by allowing us to import data from last year’s returns or other tax software, minimizing the chances of errors and omissions.

One of the standout features is the ability to create and e-file W-2s and 1099s directly through Fast Employer Forms,making tax reporting straightforward for both employees and contractors. The software also includes five federal e-files and one State e-file (with state filing available separately). Moreover, with the introduction of live tax advice, we can connect with tax experts for personalized guidance as we prepare our returns. With its up-to-date compliance with the latest tax laws and an Audit Risk Meter to help us navigate potential audit triggers,this product stands out as a reliable choice for our tax preparation needs.

| Feature | Details |

|---|---|

| Supported Platforms | PC / Mac (requires MacOS Ventura 13 or Sonoma 14) |

| Federal E-files | 5 included |

| State E-file | 1 included; additional fee for state filing |

| Technical Support | U.S.-based, hours may vary |

| Live Tax Advice | one-on-one expert advice available (fee applies) |

Get Started with TurboTax Home & Business 2024

Key Features and Functionality of TurboTax Home & Business

Key Features and Functionality

This software is expertly tailored for individuals who are self-employed, independent contractors, freelancers, or small business owners, ensuring that we can navigate our unique tax situations with ease. It boasts a robust search function that scans over 375 personal and small business deductions and credits, maximizing the refunds we can claim. An essential benefit is the inclusion of 5 federal e-files and 1 State e-file, available through download, with additional state filing options. Furthermore, the program provides access to U.S.-based technical support, and for those who prefer personal assistance, it offers Live Tax Advice for one-on-one guidance during the tax preparation process (note that a fee applies).

Another significant advantage is the ability to import data from prior TurboTax returns or compatible tax software, which provides a head start on tax filing.The Quick Employer forms feature simplifies the creation and e-filing of W-2s and 1099s for our employees and contractors, while the comprehensive Audit Risk Meter checks our returns for potential audit triggers, increasing our confidence in avoiding costly errors.The program stays current with the latest tax laws, ensuring we have access to up-to-date data. For those using Mac, compatibility is required with macOS Ventura 13 or Sonoma 14 to operate effectively.

In-Depth Analysis of User experience with TurboTax

The user experience with this tax preparation software is designed to cater specifically to the needs of self-employed individuals and small business owners.One of us found the interface intuitive, allowing for seamless navigation through various sections. Additionally, the software’s ability to search over 375 personal and small business deductions ensured that we didn’t miss out on any potential credits. Notably, the Audit Risk Meter provides peace of mind by evaluating our return for potential audit triggers, helping us feel secure about our filing. The software also simplifies the process of creating and e-filing W-2s and 1099s through Quick Employer Forms, which was particularly beneficial for those of us managing multiple contracts.

moreover, the integration features were exceptionally user-pleasant as we could easily import previous tax information from last year’s return or other software, speeding up our preparation time. The software also stays updated on the latest tax laws, eliminating worries about compliance. Access to U.S.-based technical support proved useful whenever we encountered questions or issues. While one-on-one tax advice incurs an extra fee, many of us appreciated the option to connect with a tax expert for personalized guidance during the filing process. the combination of accessible features and robust support enhances the user experience significantly, making it a reliable choice for tax preparation.

Get Started with TurboTax Now!

Recommendations for Maximizing the Benefits of TurboTax Home & Business

To fully leverage the capabilities of this tax software, we recommend beginning with a thorough review of last year’s tax return. By importing previous data, we can expedite our entry process and reduce input errors. It’s also crucial to take advantage of the comprehensive search feature that identifies over 375 deductions and credits—this can significantly enhance our tax position. For small business owners, understanding industry-specific deductions can maximize savings. Keeping accurate records and receipts for business expenses will further streamline the process of claiming thes deductions.

In addition, we should utilize the live tax advice option available within the software. Having direct access to a tax expert can clarify intricate tax laws and ensure we are filing correctly. While preparing our return, checking the audit Risk Meter will help us identify potential issues that could trigger an audit, allowing for more proactive measures to be taken. Incorporating these strategies not only helps us file our taxes confidently but can also result in considerable savings and peace of mind.

Customer Reviews Analysis

Customer Reviews Analysis

In our analysis of customer feedback for the TurboTax Home & Business 2024 Tax Software, several recurring themes and insights have emerged. We gathered a variety of reviews from customers who have used this tax software,and the feedback provides a comprehensive understanding of its strengths and areas for enhancement.

Key Strengths

| Strength | Description |

|---|---|

| User-Friendly Interface | Many users appreciate the intuitive, menu-driven design, making it easy to navigate through tax filing. |

| Import Features | The ability to import previous year’s tax data and financial information from banks simplifies the filing process significantly. |

| Thoroughness | Reviewers note the comprehensive coverage of various tax situations,making it suitable for both personal and business taxes. |

| Reliability | TurboTax is generally seen as reliable,with users stating that it performs well year after year. |

Common Concerns

| Concern | Description |

|---|---|

| Software Availability | some users were frustrated by the shift to a digital-only download model, raising concerns about accessibility. |

| System Requirements | Customers noted the increased memory requirements, which necessitated hardware upgrades for some users. |

| Cost | A few reviewers expressed that the software’s pricing is high, especially considering the lack of a physical disc option. |

| Limited Guidance for Specific Forms | Some feedback indicated that while TurboTax covers most forms well, there were gaps in guidance for less common forms. |

Overall Sentiment

customer reviews indicate that TurboTax Home & Business 2024 is a robust and reliable option for tax preparation, particularly for users with both personal and business tax needs. While there are concerns regarding the transition from physical media to downloadable software and increasing system requirements, the strengths of ease of use, thoroughness, and reliability resonate strongly among users. We find that it remains a highly recommended tool for both new and returning users alike.

Pros & Cons

Pros & Cons of TurboTax Home & Business 2024

In our evaluation of TurboTax Home & Business 2024, we have compiled a list of pros and cons to help you make an informed decision about this tax software. Below, we outline the strengths and weaknesses we identified during our review.

| Pros | Cons |

|---|---|

| Comprehensive deduction search capability, identifying over 375 personal and small business deductions and credits. | State e-file not included; must be purchased separately, which may increase overall cost. |

| Includes five federal e-files, making it suitable for multiple tax returns. | Live tax advice incurs an additional fee, which may not be ideal for all users. |

| Easy import of last year’s data from previous TurboTax or other tax software, streamlining the filing process. | Mac users need to meet specific OS requirements (macOS Ventura 13 or Sonoma 14). |

| User-friendly interface helps guide self-employed individuals through tax filing. | The software may require an Intuit account to access and manage tax data, possibly complicating the setup for some users. |

| Audit Risk Meter provides proactive measures to check for potential audit triggers. | Technical support availability may vary, leading to potential delays in assistance during critical filing periods. |

TurboTax Home & Business 2024 offers a solid set of tools tailored for self-employed individuals and small business owners. However, potential users should weigh the additional costs and system requirements against these benefits to determine if it fits their needs.

This HTML content provides a balanced view of the pros and cons associated with TurboTax Home & Business 2024, formatted in a way that is easy to read and understand.

Embody Excellence

TurboTax Home & Business 2024 continues to deliver a robust solution for navigating the complexities of personal and small business tax preparation. Its comprehensive features, including the ability to search for over 375 deductions, import previous tax data, and receive industry-specific tax guidance, make it a worthwhile investment for self-employed individuals and small business owners alike. The added support for e-filing W-2s and 1099s streamlines the process, while the Audit Risk Meter provides an extra layer of assurance against common mistakes.

However, it’s important to note that while TurboTax remains a leading choice in tax software, users should always review their entries carefully and stay informed about the latest tax regulations. For those seeking a user-friendly platform that enhances their filing experience and maximizes their potential refunds, TurboTax Home & Business 2024 is certainly worth considering.

If your ready to take control of your tax situation with confidence,we encourage you to explore turbotax Home & Business 2024 today. You can find more information and make a purchase by clicking the link below:

TurboTax Home & Business 2024: Get Started Now!